The easiest way to invest in fine wines

Wine Vault simplifies fine wine investing with a blockchain powered, ETF-like wine fund. Our vision is to make fine wines a top asset class for investors globally and are reinventing the industry by utilizing blockchain technology for lower transaction costs, improved accessibility, and increased market liquidity.Wine Vault makes investing in fine wines easy and accessible for all.

NEW! Try our sommelier service for alternative wine recommendations based on your favorite wine!

Investing in Wine

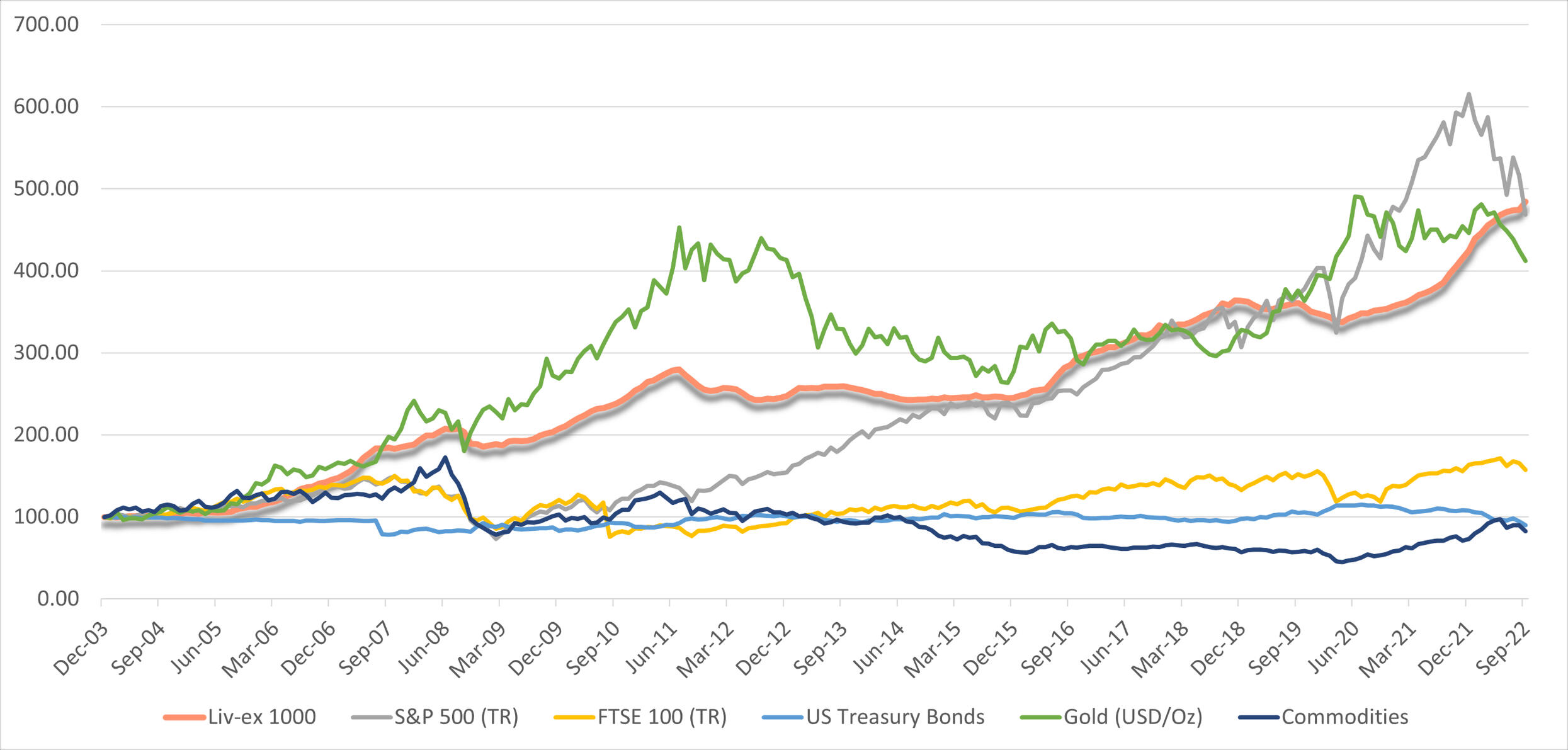

Investing in fine wine is a smart and savvy way to diversify your portfolio and potentially realize significant returns on your investment. The wine market has a long history of appreciating in value over time, with certain bottles reaching prices that can rival those of fine art and precious gems.Fine wine is a tangible and luxurious asset that not only has the potential to appreciate in value, but it also allows investors to enjoy the wine they have invested in. This is a unique benefit that sets fine wine apart from other traditional investments such as stocks or bonds.The exact size of the market can vary depending on how it is defined and measured, but most estimates put the global market for fine wines at around $300 billion. The market is primarily composed of high-end wines that are produced in limited quantities and command premium prices.One of the most compelling reasons to invest in fine wine is its historical lack of volatility. The wine market is not subject to the same fluctuations and market fluctuations as other traditional investments. This makes it a more stable option for investors who are looking to protect their wealth and minimize risk.

Source: Liv-ex and investing.com as of 30 September 2022. US Treasury bonds = iShares 7-10 US Treasury Bond. Commodities = Bloomberg Commodity Index. Past performance is not a guarantee of future returns.

For years, the fine wine market has been hindered by a lack of access and liquidity, making it difficult for new investors to enter the market and old investors to sell their wines without incurring significant losses or high commission fees.To address these issue, we founded Wine Vault. We wanted to combine the power of an appreciating commodity with cutting edge technology and created CORK - the first fine wines backed digital stablecoin.

INDUSTRY LEADING PARTNERS

01.

WINE VAULT

Wine Vault is designed to be the blockchain equivalent of an ETF for fine wines. The platform was created to make fine wine investing easy and accessible. Our vision is to bring fine wines into the forefront as a desirable asset class for investors worldwide, by harnessing the power of blockchain technology. This will result in decreased transactional costs through automation, improved accessibility for investors of all types, and increased market liquidity through tokenization of assets, making Wine Vault the preferred investment vehicle for fine wine enthusiasts and investors alike.Wine Vaults platform token is called CORK. It's a token fully collateralized by a diverse portfolio of fine wines, stored with some of the most reputable fine wine brokers around the world. This unique combination of traditional and digital assets offers the best of both worlds: the stability of a stablecoin and the potential for substantial returns of one of the world's best-performing asset classes.The first 200 000 CORK tokens are minted with an initial price of $1/token. The value of each token is directly tied to the market value of the collateralized wines. This means that as the value of the wines increases, so does the value of the CORK tokens.As a token holder, you don't have to do anything except hold on to your tokens. The wines are stored and insured by CORKs partnering trade houses, and to cover these costs, CORK mints annually 2% tokens that it sells. This ensures that your investment is always safe and secure.

02.

Why invest in fine wines?

Fine wines have proven to be an exceptional investment opportunity, According to the Liv-ex 1000 index (which tracks the performance and returns of 1000 of the best wines in the world), fine wine offers investors an average annual return of about 18% (since its inception 2004). Not only are fine wines a great investment, but they also serve as an effective inflation hedge as wine prices tend to increase in line with inflation.

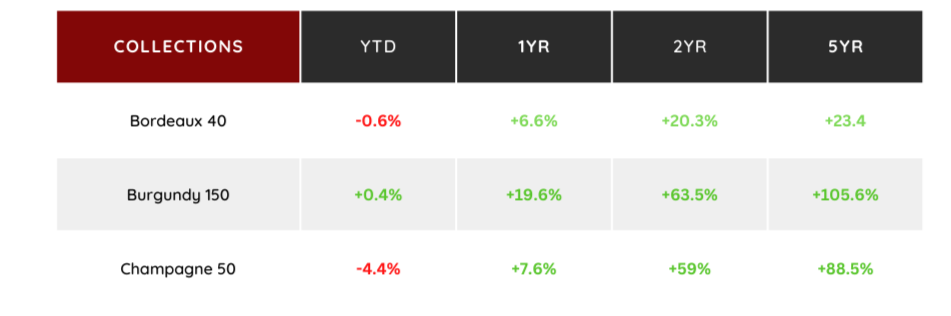

The Liv-ex Index's are the industry leading benchmarks for monitoring fine wine prices. It represents the price movement of the most sought-after fine wines on the secondary market. (Data from Feb 2023)

The consumption of fine wines is at an all-time high, however, the effects of climate change are already impacting wine production. In the coming decade or two, some of the world's renowned wine regions may struggle to survive, leading to an increased demand (and price pressure) for exceptional vintages. The time to build a great wine portfolio is now.

Fine wine investing, despite being a significant market, is not available to everyone. To obtain the finest wines and releases, one often needs to be a high-volume, high-value client. The market is dominated by handful reliable trading firms and due to this they have the freedom to set their own barriers to entry. For secure storage, insurance, and added protection, it is necessary to trade through these firms, which makes it hard to build a great cellar by yourself.Liquidity and accessibility are crucial components of any market. To address these challenges, we created Cork. By tokenizing fine wine investing, we expand access to a wider range of wine enthusiasts and bring unparalleled liquidity to this otherwise substantial but stagnant market.

03.

Wine meets Blockchain

Wine Vault is easiest way to start investing in fine wines. Our digital token, CORK is tradable on multiple exchanges and can also be bought directly from us.The CORK tokens in circulation are collateralized by the portfolio of wines Wine Vault owns so every time the the underlying value of that portfolio goes up, the inherent value of the token does the same.One of the biggest problems with fine wine investing is the assets liquidity. If you need to sell your holdings the process is costly and burdensome. CORK keeps 15% of its total assets in the exchange liquidity pools.The market for CORK tokens is always open. We are planning to get listed on different decentralized exchanges.

The crypto market has been stigmatized by fraudulent projects and therefor are extremely focused on providing our token holders with the utmost transparency. We've built real time views into both token trades and the wine portfolio and its valuation.For wine market valuations, we've partnered with LIV-EX (the Bloomberg of fine wine). Their data API provides us real time data into market pricing of each wine we hold and thanks to the nature of blockchain, all token transactions and token mints are publicly auditable.

Investing in wines through Wine Vault brings you the best benefits on the market. We keep it extremely simple, take the guess work out of investment decisions and keep the transactional and operational costs down. It's very few investment bankers who can beat S&P 500's returns and the same goes for wines.

Get in early and take advantage of this opportunity to invest in one of the most promising asset classes while benefiting from the convenience and security of the blockchain technology.

Why Wine Vault?

Wine Vault was founded by AJ, a serial entrepreneur with a passion for exceptional wines. He has been investing privately and building his own portfolio through international trade houses over the past ten years.He recognized the issue of limited access and market liquidity early on and, after getting involved in some blockchain projects in 2016, saw an opportunity to merge his passion for investing in premium wines with technology.

Investing in a managed fine wines fund like Wine Vault offers several advantages over collecting wines and storing them in your own cellar. Here’s an overview of some top reasons why it may make sense to invest in Wine Vault over a private cellar :

DIVERSIFICATION: Investing in a fine wine fund allows you to diversify your wine collection across a range of different wines, producers, and regions. This can help to mitigate risks associated with individual bottles or vintages and can provide exposure to a broader range of wines and vintages.

EXPERTISE: Wine Vault’s trading is operated by experienced and knowledgeable professionals who have a deep understanding of the wine market and can use their expertise to make informed investment decisions. This helps to ensure that your investment is well managed and positioned for long-term growth.

ACCESS: A managed “fine wine fund” has access to wines that are not available to individual collectors, either because they are rare, allocated, or sold exclusively to trade customers. This helps to provide access to wines that may otherwise be difficult or impossible to obtain.

CONVENIENCE: Investing in a fine wine fund like Wine Vault is more convenient than collecting wines yourself, as it eliminates the need to source and purchase individual bottles, arrange for storage, and manage your collection over time. This can be particularly beneficial for individuals who do not have the time or resources to dedicate to building and managing their own wine collection.

LIQUIDITY: A managed fine wine fund may offer greater liquidity than a private collection, as it can be bought and sold on secondary markets. This can provide greater flexibility for investors who may need to liquidate their investment in the future.

Wine Vault was created with the goal of revolutionizing the wine investment landscape as a nimble and cost-effective alternative for the next generation of wine investors.

All asset classes need liquidity in order to be efficient. The amount of wine sold, bought and consumed every day by millions of people is a testament that Wine Vault with its digital token CORK, has huge potential to disrupt the $300bn fine wines market.

Roadmap

Our ambitious plan is to start minting CORK tokens in the beginning of July 2023. A lot of preparatory work has been done and smart contract architecture has been planned. Next we start executing and getting the ball rolling.

Current status:

167 wines, 231 cases, 1292 bottles in cellar

Current cellar valuation: $ 207 500

Incorporation and compliance work started

Launch planned for 1st July 2023

Coming up next:

Initial mint of CORK tokens

Launch CORK on a DEX (or CEX)

New website

Swap widget on site

First reserve audit

Social media channels (for community building)

Join our pre-launch mailing list to get news as we progress!

© Wine Vault 2023